NuBank Apk Download For Android Free 2023

Description

About NuBank Apk Download

NuBank Apk Download was born to eliminate the complexity of traditional banks and give everyone back control of their financial lives.

We are the largest financial services technology company in Latin America.

And that’s why our app was created to reflect everything we believe in.

With him you get a transparent, simple and fair experience.

As it always should be.

This experience is made even more fulfilling when we use proprietary technology.

So, apart from being safe, you can always control everything.

Control expenses, transactions, transfers, payments and voucher issuance in a seamless and integrated manner.

No jokes, obscure charges and no asterisks to say otherwise.

And you’re still reading this description, an exclusive list of complications for those who choose to go nude:

- Free Nuconta

- A human service focused on what’s best for you

- Credit card with no annual fee and accepted worldwide

Simplicity and peace of mind

NU Payments S.A. Payment institution. CNPJ: 18.236.120/0001-58.

Nu Financiera S.A. CNPJ: 30.680.829/0001-43.

R. Capote Valente, 39 – Pinheiros, Sao Paulo – SP, 05409-000.

Features of NuBank Apk Download

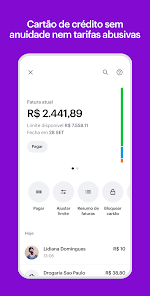

- Account Management: View account balances, transaction history, and details of your NuBank account.

- Payments and Transfers: Make payments to other individuals or businesses, transfer funds between accounts, and pay bills or utilities.

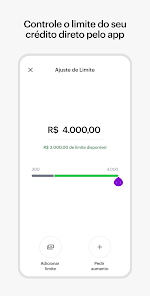

- Card Management: Manage your NuBank credit or debit card, including blocking/unblocking, setting spending limits, and tracking transactions.

- Notifications: Receive real-time notifications for account activities, such as transactions, card usage, or upcoming bill payments.

- Security Features: Set up security measures like PIN codes, biometric authentication (fingerprint or facial recognition), and two-factor authentication for enhanced account security.

- Savings and Investments: Explore and manage savings accounts or investment options offered by NuBank.

- Customer Support: Access customer support features such as live chat, FAQs, or contact information for assistance with any issues or inquiries.

- Budgeting and Expense Tracking: Track your expenses, categorize transactions, and set budgeting goals to better manage your finances.

- Personalization: Customize your app experience with features like account preferences, transaction categorization, and personalized spending insights.

- Rewards and Benefits: Access any loyalty programs, cashback rewards, or special offers provided by NuBank.

Pros And Cons of NuBank Apk

Pros:

- Convenience: NuBank’s mobile app allows you to manage your finances anytime, anywhere, providing convenient access to your account, transactions, and other banking features.

- User-Friendly Interface: NuBank is known for its intuitive and user-friendly interface, making it easy to navigate and perform various banking tasks.

- No-Fee Banking: NuBank is often recognized for its transparent fee structure, which may include lower or no fees for services such as account maintenance, transfers, and bill payments.

- Simplified Account Opening: NuBank typically offers a streamlined account opening process that can be completed entirely through the mobile app, eliminating the need for physical paperwork.

- Financial Insights: The app may provide helpful financial insights and tools, such as personalized spending analysis, budgeting features, and transaction categorization, to help users better understand their finances.

Cons:

- Limited Physical Branches: NuBank primarily operates as a digital bank, which means it may have a limited physical branch network. This can be a disadvantage for customers who prefer or require in-person banking services.

- Limited Product Offerings: While NuBank may provide essential banking services like savings accounts and credit cards, its product offerings may be limited compared to traditional banks. This could be a drawback for individuals seeking a wide range of financial products.

- Customer Support: Some users have reported issues with NuBank’s customer support, including delays in response times or difficulties in reaching a representative. However, this can vary based on individual experiences.

- Limited International Features: NuBank’s services may be primarily focused on the domestic market, so international banking features, such as easy currency conversion or international transfers, may be limited or unavailable.

- Dependency on Technology: As with any digital banking app, reliance on technology and internet connectivity is a potential drawback. Service interruptions or technical glitches could temporarily limit access to your account or banking services.

You may choose some similar interesting applications like Bybit Apk

What's new

- UI Enhancement

- Bug Resolved

- User-Friendly Interface

- Performance improvement

Images

Download links

How to install NuBank Apk Download For Android Free 2023?

1. Tap the downloaded APK file.

2. Before installing the application on your phone, you need to make sure that third-party applications are allowed on your device.

Here are the steps to make this possible: Open Menu > Settings > Security > and check for unknown sources to allow your Android device to install apps from sources other than the Google Play store.

3. After completing the above operations, Go to the downloaded folder from the device browser and click on the file.

4. Touch install.

5. Follow the steps on the screen.